problogclub.ru

Community

Programming Languages For Machine Learning And Ai

Java has been called the “jack of all trades” of programming languages. It is hugely popular with programmers and is starting to gain ground with machine. Python has established itself as the de facto standard for AI and machine learning, and for good reason. Its simplicity, versatility, and a robust ecosystem of. Python is among the most popular programming languages for AI development due to its rich ecosystem of libraries and fast learning curve. Lisp is an old and best programming language for machine learning and AI. Developers use it to develop project architectures and AI-based applications. It. The best programming languages for artificial intelligence that may meet various demands in software development and design include Java, Python, Lisp, Prolog. When looking at artificial intelligence and machine learning development, C/C++ is often the choice for AI in games, robot locomotion, and network security. We'll say it one more time: Python is the most popular programming language in machine learning and data science. If your job involves building machine learning. Java is also the most widely used programming language by all developers and programmers to develop machine learning solutions and enterprise development. 1. Python No doubt, Python is one of the most powerful AI programming languages & machine learning applications. Java has been called the “jack of all trades” of programming languages. It is hugely popular with programmers and is starting to gain ground with machine. Python has established itself as the de facto standard for AI and machine learning, and for good reason. Its simplicity, versatility, and a robust ecosystem of. Python is among the most popular programming languages for AI development due to its rich ecosystem of libraries and fast learning curve. Lisp is an old and best programming language for machine learning and AI. Developers use it to develop project architectures and AI-based applications. It. The best programming languages for artificial intelligence that may meet various demands in software development and design include Java, Python, Lisp, Prolog. When looking at artificial intelligence and machine learning development, C/C++ is often the choice for AI in games, robot locomotion, and network security. We'll say it one more time: Python is the most popular programming language in machine learning and data science. If your job involves building machine learning. Java is also the most widely used programming language by all developers and programmers to develop machine learning solutions and enterprise development. 1. Python No doubt, Python is one of the most powerful AI programming languages & machine learning applications.

From data analysis to deep learning, Python's vast AI and ML-focused library ecosystem, combined with its strong data handling and visualization capabilities. #1 Python: The Cornerstone of AI Development · Scikit-learn: A versatile tool for training machine learning models. · PyTorch: Favored for visual and natural. Pursuing a career in machine learning or AI will require a little coding as it is implemented using languages such as C++, Java, and Python. In the article we'll explore the eight most popular programming languages for creating Artificial Intelligence systems, their peculiarities, and use cases. 1> Python: Python is widely used in both AI and robotics due to its simplicity, readability, and extensive libraries. Popular libraries like TensorFlow, PyTorch. AI encompasses various subfields, including machine learning, natural language processing, computer vision and robotics. These subfields focus on different. Choosing a language that simplifies coding and offers libraries tailored for tasks like machine learning and data analysis is essential. For example, Python is. This programming language might not be the first choice for AI development, but it was used to build many of the most popular Machine Learning libraries. In. 1. Python is a powerful tool for AI development. According to the PYPL index, it has a % share rate and it is the 1st for popularity among programming. Python is unequivocally the frontrunner for AI/ML development. Versatility: From data engineering with numpy and pandas to machine learning via. All the cool bearded gurus in what's left of AI research use Lisp. There are two big camps: Common Lisp and Scheme. They have different syntax, etc. Lots of. Python has become the most widely adopted programming language for machine learning. Python: The Powerhouse of AI · Boasts an extensive collection of libraries for AI and machine learning, including NumPy, Pandas, Scikit-Learn, and Matplotlib. This is why Tesla relies heavily on C++, C, and CUDA for hardware-level implementation of their Deep Learning models rather than Python. C++ Logo Icon. C++. Java has been called the “jack of all trades” of programming languages. It is hugely popular with programmers and is starting to gain ground with machine. This article will examine why Python is the best choice for AI and ML and how it stacks up against other popular languages. Computer-based intelligence or artificial intelligence is profoundly affecting the world we live in, with new applications rising steadily. Brilliant designers. Additionally, key libraries such as TensorFlow and PyTorch have made Pythong a go-to language for machine learning, deep learning, and artificial intelligence. Digital health Influencer || Vice President at · Python is one of the widely used programming languages for AI because of its simplicity.

Best Buy Pricematch

We will price match the final sale price of identical items, in new condition, in retail packaging, available to purchase at any brick and mortar store. On the other hand, Home Depot focuses on price management policies and makes changes from time to time, allowing it to set the best price possible. The company. You can price match within the entire duration of the return policy. Does Best Buy price match Black Friday? While Best Buy does have a generous price match program, it comes with a few exceptions. One of them is that you can. To get an online price match from Best Buy, you'll need to call them directly at BEST-BUY. Be prepared to direct the company rep to the ad or website that. Best Buy has simplified tech shopping, with warp-speed checkout, Curbside Pickup, limited runs, and can't-miss deals. Shop from home or enhance your. Yes, Best Buy does price match with Apple. However, there are some conditions and restrictions to bear in mind. Best Buy will only match prices. If our price isn't already the best you see advertised, we'll match the price you find in a competitor's ad or online. Learn more about our price match. The Home Depot guaranteed low price and price match ensures you save money on great appliances, power tools, décor items, patio sets and more. We will price match the final sale price of identical items, in new condition, in retail packaging, available to purchase at any brick and mortar store. On the other hand, Home Depot focuses on price management policies and makes changes from time to time, allowing it to set the best price possible. The company. You can price match within the entire duration of the return policy. Does Best Buy price match Black Friday? While Best Buy does have a generous price match program, it comes with a few exceptions. One of them is that you can. To get an online price match from Best Buy, you'll need to call them directly at BEST-BUY. Be prepared to direct the company rep to the ad or website that. Best Buy has simplified tech shopping, with warp-speed checkout, Curbside Pickup, limited runs, and can't-miss deals. Shop from home or enhance your. Yes, Best Buy does price match with Apple. However, there are some conditions and restrictions to bear in mind. Best Buy will only match prices. If our price isn't already the best you see advertised, we'll match the price you find in a competitor's ad or online. Learn more about our price match. The Home Depot guaranteed low price and price match ensures you save money on great appliances, power tools, décor items, patio sets and more.

If you find a current lower price on an identical in-stock item from another local retailer, we'll match the price. Just show the website, ad. Like Target and Walmart, Best Buy only matches prices for new merchandise, not used or refurbished goods. It also doesn't match prices for any marketplace or. Since Amazon is an online entity, it focuses only on online prices for TV price matching. All of the major electronics retailers like Best Buy, Target, Walmart. Does Best Buy price match Black Friday? While Best Buy does have a generous price match program, it comes with a few exceptions. One of them is that you can. A list of qualified competitors whose prices qualify for the Best Buy Price Match Guarantee. Since Amazon is an online entity, it focuses only on online prices for TV price matching. All of the major electronics retailers like Best Buy, Target, Walmart. Should our own price be reduced after your purchase, present us with your original receipt within 30 days of purchase and we will match the price and refund you. Best Buy's Price Match Guarantee ensures that you are getting a great price on your purchase. Whether you're looking for a new gadget to make your life a. - Price Match requests must be made within 7 days of your order date. - Competitor multi-box discounts will only be honored if the minimum quantity to receive. Find the best Black Friday Deals at Best Buy at the Black Friday Sale Event. Shop deals on all kinds of electronics, including the latest tech gifts. Will you price match? Yes. If you have previously purchased a Deal of the Day item and are within your Return & Exchange time period, we will match the Deal. To request a price match, provide proof of the current lower price at Guest Services in your local Target store. For problogclub.ru purchases, call problogclub.ru Guest. In Store Price Match Guarantee: If you find a currently available lower price on a new, identical item, show us the lower price when you buy the item at a. Shop with confidence and don't worry about missing out on the best price. If you see a lower price on problogclub.ru for a product you bought from Dell in the 30 days. problogclub.ru will match a lower price (including shipping and handling) from select authorized online retailers on any identical stock assortment item. Store Pickup and our Price Match Guarantee: If your item is offered at a lower price in the store or at problogclub.ru when you pick it up, you may request a price. Promotions · Pricing may vary between retail stores and problogclub.ru · Sometimes when we lower prices, other retailers will decrease their prices in response. at any time. Find a lower advertised price by Newegg or a major retailer,* with the same brand and model number. Let us know within What Qualifies For Best Price Guarantee? · The product is an identical match. Same brand, same model number, same color, same size. · The product is immediately.

Va Rates For Refinance

National year fixed VA refinance rates remain stable at %. The current average year fixed VA refinance rate remained stable at % on Saturday. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. As of today, August 23rd, , the year fixed VA loan purchase rate is % — the same as last week's average. Today's year fixed VA refinance loan. Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages. Funding fees typically range between % to % for purchase loans. You can pay the funding fee either by including it in your overall mortgage loan (also. VA IRRRL Veterans, Retirees and Active Duty Personnel can refinance an existing VA guaranteed loan to reduce the interest rate or switch an adjustable rate to. VA IRRRL rates. % interestSee note2; % APRSee note3. You can include all costs in a VA IRRRL. We'll cover your appraisal, title and funding fees. The U.S. Department of Veterans Affairs' (VA) Interest. Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA. Check out 30 year Veteran Affairs (VA) fixed refinance mortgage rates with U.S. Bank. Learn more to see if this is the right option for you. National year fixed VA refinance rates remain stable at %. The current average year fixed VA refinance rate remained stable at % on Saturday. Average Mortgage Rates, Daily ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. %. As of today, August 23rd, , the year fixed VA loan purchase rate is % — the same as last week's average. Today's year fixed VA refinance loan. Thanks to the government insurance of these mortgages, lenders are able to offer competitive VA loan rates that are usually lower than conventional mortgages. Funding fees typically range between % to % for purchase loans. You can pay the funding fee either by including it in your overall mortgage loan (also. VA IRRRL Veterans, Retirees and Active Duty Personnel can refinance an existing VA guaranteed loan to reduce the interest rate or switch an adjustable rate to. VA IRRRL rates. % interestSee note2; % APRSee note3. You can include all costs in a VA IRRRL. We'll cover your appraisal, title and funding fees. The U.S. Department of Veterans Affairs' (VA) Interest. Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA. Check out 30 year Veteran Affairs (VA) fixed refinance mortgage rates with U.S. Bank. Learn more to see if this is the right option for you.

A VA Streamline loan of $, for 30 years at % interest and % APR will have a monthly payment of $1,

Apply for a Veteran Affairs (VA) refinance loan with U.S. Bank today. See our competitive VA refinance rates for 15 or year loans. Home loan refinance options · VA Cash-out Refinance LoanSee note1. %See note2; %APR · VA Interest Rate Reduction Refinance Loan (IRRRL). %See. How much can you get? ; Term. VA 30 year fixed ; Rate. % ; Monthly Payment*. $2, Rates and Costs · Origination fee of up to 1% · VA Funding Fee (unless borrower is exempt) · Reasonable interest rate discount points · VA appraisal fee · Credit. The national average year VA refinance interest rate is %, down compared to last week's rate of %. One of the key factors in picking out the best VA loan option is the APY rate, which can save you substantially on payments and overall interest costs. Don't neglect overall costs. You will need to pay a funding fee to refinance your VA mortgage. For IRRRLs, this fee is equal to % of the loan amount. On a. $2,/mo. A $2, monthly payment assumes $, loan amount at % (Median Interest Rate) over months. PNC Bank offers VA Home Loan refinancing for active military and veterans. Check current VA loan rates and get started today! VA Cash-Out refinance closing costs are often 3% to 5% of the loan amount and vary by lender, although the VA limits what lenders can charge. The VA sets the. loan balance. *Veterans entitled to VA compensation may be exempt from the Funding Fee. What is an IRRRL? IRRRL stands for Interest Rate. Reduction Refinancing. An IRRRL is a VA-guaranteed loan made to refinance an existing VA- guaranteed loan, generally at a lower interest rate than the existing VA loan, and with lower. The Cash-Out Refinance Loan can also be used to refinance a non-VA loan into a VA loan. Market Interest Rate, VA funding fee, and no pre-payment penalties. A VA Streamline Refinance can save you more · No appraisal, PMI, or closing costs · No income or asset verification required · Rates as low as % (APR %). You'll pay a fee between % and % of the loan amount for VA cash out refinancing. Some disabled veterans and surviving spouses may be exempt from paying. What are the current VA refinance rates? · Year: Interest Rates are at %, and Annual Percentage Rates are at % · Year: Interest Rates are at. Rates as of Aug 24, ET. The interest rate above shows the option of purchasing discount points to lower a loan's interest rate and monthly payment. One. Nothing stands out more with Navy Federal than the IRRRL VA year mortgage refinance rates starting as low as %. Compared to the rest of the industry. If you're a Freedom Mortgage customer, you can likely apply on the phone. Easy credit qualification. We can usually accept lower credit scores for VA refinances.

Interest On 15 Year Loan

Additionally, the current national average year fixed mortgage rate decreased 6 basis points from % to %. The current national average 5-year ARM. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Lower interest rate: Interest rates on year loans are usually lower than on year loans. Less time to own your home: With a year term, you'll pay off. A year mortgage can have higher payments than a year mortgage, but can save you money in interest. Use our free calculator to estimate your payments and. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. The average fixed year refinance rate was % in mid-April, remaining below the 7% mark reached in November If you want to lower your mortgage rate. As of and , the average year fixed mortgage rate has dropped even further to % and %, respectively. In , the average year fixed. In the Loan term field, enter the length of your loan — usually 30 years, but could be 20, 15 or Enter your interest rate. In the Interest rate field, input. If you have a year mortgage at % and can get a year refinance loan at %, refinancing can help you pay off your loan faster. But make sure you can. Additionally, the current national average year fixed mortgage rate decreased 6 basis points from % to %. The current national average 5-year ARM. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. Lower interest rate: Interest rates on year loans are usually lower than on year loans. Less time to own your home: With a year term, you'll pay off. A year mortgage can have higher payments than a year mortgage, but can save you money in interest. Use our free calculator to estimate your payments and. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. The average fixed year refinance rate was % in mid-April, remaining below the 7% mark reached in November If you want to lower your mortgage rate. As of and , the average year fixed mortgage rate has dropped even further to % and %, respectively. In , the average year fixed. In the Loan term field, enter the length of your loan — usually 30 years, but could be 20, 15 or Enter your interest rate. In the Interest rate field, input. If you have a year mortgage at % and can get a year refinance loan at %, refinancing can help you pay off your loan faster. But make sure you can.

What Are Today's Mortgage Rates? ; year fixed-rate mortgage: · The average APR for the benchmark year fixed mortgage fell to %. · %. ; year fixed-. Save on interest with a fixed, lower rate. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. 5% lower. It is this lower interest rate added to the shorter loan life that creates real savings for year fixed rate borrowers. The possible disadvantages. When choosing between year and year mortgages, remember that longer terms usually mean smaller payments, but higher overall interest costs. How much interest will you pay on the new loan? If you take out a year mortgage at % for $,, your new payment would be $3,, and you'd pay. The current national average 5-year ARM mortgage rate is down 2 basis points from % to %. Last updated: Wednesday, September 4, See legal. A 15 year fixed loan can be a smart choice depending on your current income and future goals. One way to look at a 15 year fixed loan is "short term pain for. Graph and download economic data for Year Fixed Rate Mortgage Average in the United States (MORTGAGE15US) from to about year. The year mortgage has some advantages when compared to the year, such as less overall interest paid, a lower interest rate, lower fees, and forced. With a fixed-rate mortgage, you pay the same interest rate throughout the life of your loan. For example, a year mortgage with a 5% fixed rate will have a 5%. The average APR on a year fixed-rate mortgage rose 2 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 4 basis. The current average rate for a year fixed mortgage is %. Find your best rate below. With a year fixed rate loan, you'll completely pay off your mortgage in just 15 years. Because your interest rate is locked, your principal and interest. The 15 year loan will cost you $ more monthly and save you $34, in total interest compared to the 20 year loan. The 15 year loan will cost you. The interest rate is lower on a year mortgage, and because the term is half as long, you'll pay less interest over the life of the loan. The monthly payment. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. A year Fixed-Rate mortgage is a type of home loan that will take 15 years to pay back and has a fixed interest rate and monthly payments. Current year mortgage rates are averaging around %. But keep in mind, your rate will depend on many financial factors. Use a year vs. year mortgage calculator to help you determine exactly how much you can spend on a house with each loan type while still staying within. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options.

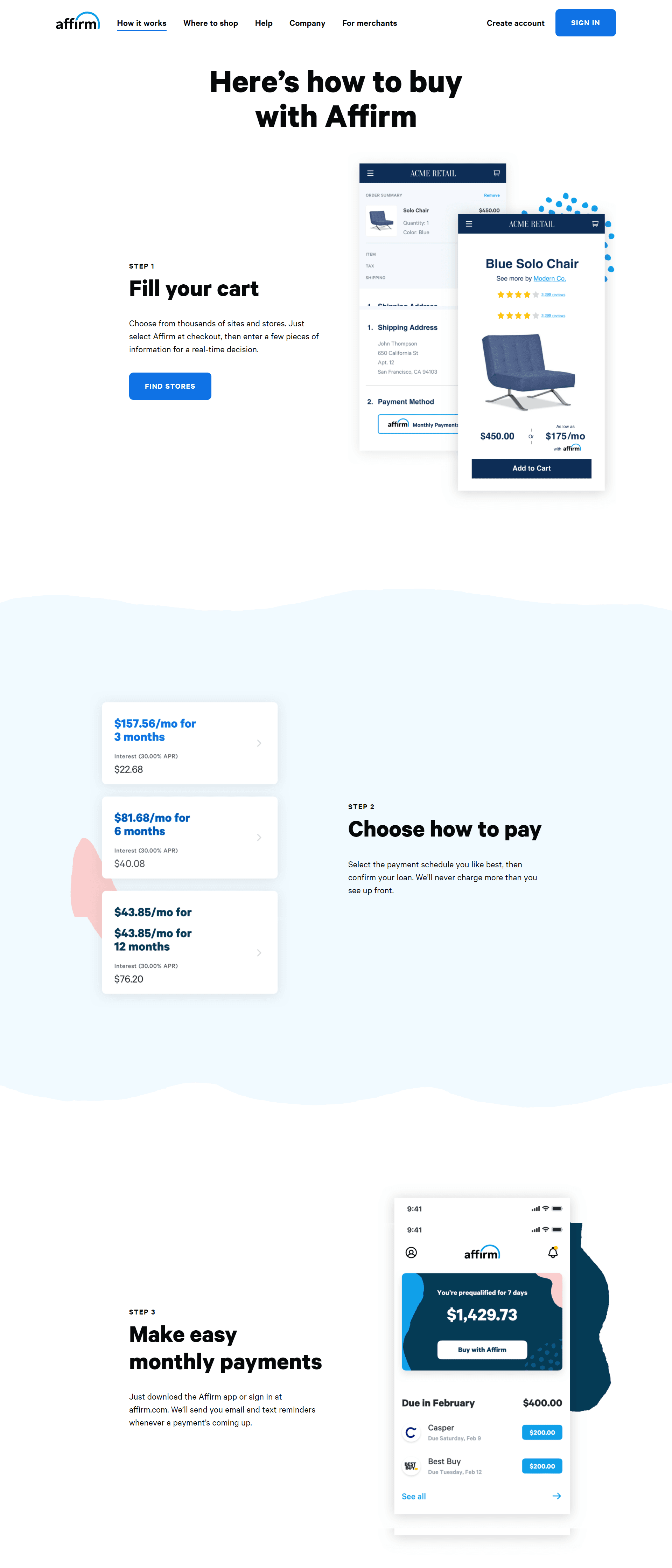

Will Affirm Build My Credit

Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase. Afterpay, Klarna®, Affirm® and other BNPL payment options can make it easier to buy online. But it's important to know how BNPL services could affect your. Can you build credit with Affirm or Afterpay? When you borrow with Affirm, your positive payment history and credit use may be reported to the credit bureaus. Yes-you can return an item you bought with Affirm by initiating the return process with the store. Does checking my eligibility affect my credit score? No-your. Affirm shouldn't tank your score! On-time payments = good, multiple loans = higher utilization (not ideal). Short-term loans like Affirm have less impact than. Does checking my eligibility affect my credit score? No—your credit score won't be affected when you create an Affirm account or check your eligibility. If. Select explains how some point-of-sale loans can decrease your credit score even when you're making your payments on time and in full. Affirm may report any loan with delinquent payments, which can damage your credit score. Does Affirm Charge Interest and Fees? Unlike with credit cards, you do. Yes, Affirm can help build credit when used responsibly. Timely payments and responsible credit management contribute positively to your credit. Your rate will be 0–36% APR based on credit, and is subject to an eligibility check. Affirm Pay in 4 payment option is 0% APR. Options depend on your purchase. Afterpay, Klarna®, Affirm® and other BNPL payment options can make it easier to buy online. But it's important to know how BNPL services could affect your. Can you build credit with Affirm or Afterpay? When you borrow with Affirm, your positive payment history and credit use may be reported to the credit bureaus. Yes-you can return an item you bought with Affirm by initiating the return process with the store. Does checking my eligibility affect my credit score? No-your. Affirm shouldn't tank your score! On-time payments = good, multiple loans = higher utilization (not ideal). Short-term loans like Affirm have less impact than. Does checking my eligibility affect my credit score? No—your credit score won't be affected when you create an Affirm account or check your eligibility. If. Select explains how some point-of-sale loans can decrease your credit score even when you're making your payments on time and in full. Affirm may report any loan with delinquent payments, which can damage your credit score. Does Affirm Charge Interest and Fees? Unlike with credit cards, you do. Yes, Affirm can help build credit when used responsibly. Timely payments and responsible credit management contribute positively to your credit.

Using a Pay-in-4 Affirm payment plan or applying for prequalification on a payment solution won't impact your credit score. Quick and convenient checkout. Place. Stress-Free-Checkout Affirm only performs a soft credit check, which won't affect your credit score. And, on-time payments with Affirm can help you build a. Shop stress-free and pay over time with flexible payments. Now select customers can take Affirm everywhere with the Affirm Card™. Why you'll love using the. When inspiration strikes, say yes with confidence — knowing you'll never pay a penny more than your purchase price. With Affirm, there are no late fees, service. Make 4 interest-free payments every 2 weeks. Great for everyday purchases. No interest or fees. No impact on your credit score. Set up easy, automatic payments. Creating an Affirm account and checking your purchasing power will not affect your credit score. At this time, only some Affirm loan types are eligible to be. Stress-Free Checkout: Affirm only performs a soft credit check, which won't affect your credit score. And, on-time payments with Affirm can help you build. Therefore, it's not a guaranteed way to build your credit. Like all Affirm states it will not report your activity to the credit bureaus if the loan. Applying is quick and easy, and it won't impact your credit score. Transparent. Know exactly what you'll pay up front—no hidden fees or surprises. Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from. Checking your purchasing power just takes a minute and won't affect your credit score. Look for the option in our app or at our partner stores. These two. Then that collection will hit your credit reports and make it very difficult for you to obtain new credit for at least a couple of years. In. Creating an Affirm account and seeing if you prequalify will not affect your credit score. If you decide to buy with Affirm, these things may affect your credit. Affirm performs a 'soft' credit check that does not affect your credit score. Affirm reports loan and payment activity to credit bureaus, allowing customers the. Affirm generally just conducts a soft pull of applicants' credit histories, which doesn't affect their scores. Depending on your credit and eligibility, your. Make sure you meet all eligibility requirements, including age and residency. · Be aware of your credit history, including your current score and debt. No, your credit score won't be affected when you create an Affirm account or check your eligibility (including checking your prequalification eligibility). When. Affirm Additional Information · Does this 'soft' credit check affect my credit score? · No, it will not affect your credit score. · Can I cancel my purchase. Does Affirm affect my credit? Your credit score won't be affected by creating an Affirm account or seeing if you pre-qualify. If you decide to buy with Affirm. 1. Does Affirm Finance affect my Credit Score? Your credit score will not be affected by creating an Affirm account or checking if you pre-qualify. If.

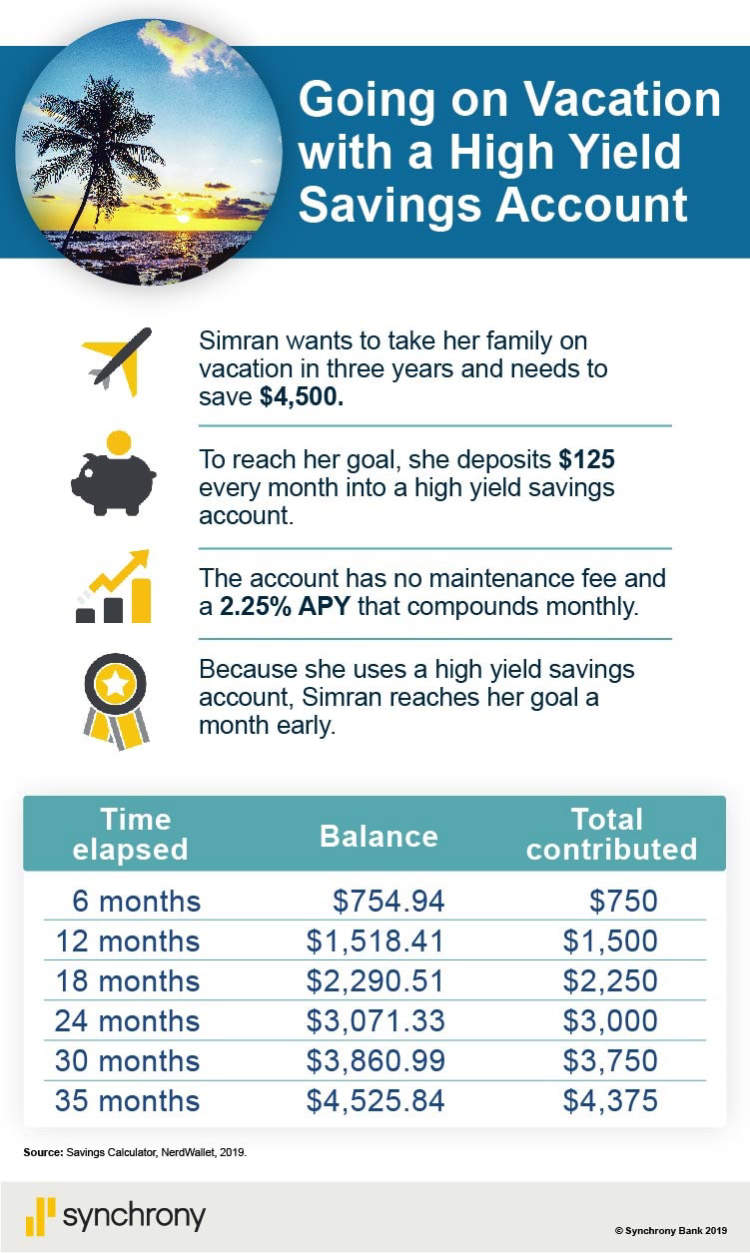

High Yield Savings Usaa

APYAnnual Percentage Yield. USAA Classic Checking, $1, or More, Bank products offered by USAA Federal Savings Bank, Member FDIC. Credit card. high-yield savings account. By Frank Gargano. June Data breaches · Truist suffers data breach, hackers claim it affects 65, employees. The threat actor. The account pays percent APY on all balances and has most of the same features as the other savings options, though parents can set up controls to choose. SoFi Bank, N.A · SoFi Savings and Checking | High Yield Savings · SoFi Bank, N.A · SoFi Savings and Checking. As of 12/5/23 ; UFB Portfolio Savings | Earn up to. Save more with PenFed's online high yield savings account, offering high **Data sourced directly from each lender listed: problogclub.ru, problogclub.ru Parent/guardian must qualify for USAA's Deposit@Mobile®. · Early access to direct deposit funds is subject to when USAA Federal Savings Bank receives notice of. FAQ: USAA Savings Rates. Does USAA offer a high-yield savings account? No. USAA's best savings interest rate is for deposits of $, or more, and it is a. Annual Percentage Yield, also known as APY, assumes that interest remains on Bank products offered by USAA Federal Savings Bank, Member FDIC. The standard USAA savings account only offers % APY with a minimum $ account balance, but also charges no monthly service fees. APYAnnual Percentage Yield. USAA Classic Checking, $1, or More, Bank products offered by USAA Federal Savings Bank, Member FDIC. Credit card. high-yield savings account. By Frank Gargano. June Data breaches · Truist suffers data breach, hackers claim it affects 65, employees. The threat actor. The account pays percent APY on all balances and has most of the same features as the other savings options, though parents can set up controls to choose. SoFi Bank, N.A · SoFi Savings and Checking | High Yield Savings · SoFi Bank, N.A · SoFi Savings and Checking. As of 12/5/23 ; UFB Portfolio Savings | Earn up to. Save more with PenFed's online high yield savings account, offering high **Data sourced directly from each lender listed: problogclub.ru, problogclub.ru Parent/guardian must qualify for USAA's Deposit@Mobile®. · Early access to direct deposit funds is subject to when USAA Federal Savings Bank receives notice of. FAQ: USAA Savings Rates. Does USAA offer a high-yield savings account? No. USAA's best savings interest rate is for deposits of $, or more, and it is a. Annual Percentage Yield, also known as APY, assumes that interest remains on Bank products offered by USAA Federal Savings Bank, Member FDIC. The standard USAA savings account only offers % APY with a minimum $ account balance, but also charges no monthly service fees.

USAA Performance First requires a minimum deposit of $10, to open the account but offers higher rates — up to a % APY if you have $, or more in the. Higher than average APY. USAA Performance First Savings Account has an annual percentage yield of up to %, which is higher than the average interest rate. Parent/guardian must qualify for USAA's Deposit@Mobile®. · Early access to direct deposit funds is subject to when USAA Federal Savings Bank receives notice of. Otherwise, your APY will be just %. SoFi savings accounts do not have fees, minimum balance requirements or a minimum opening deposit. Our top picks for. USAA does not offer a high-yield savings account at this time. It offers two savings accounts for adults: the USAA Savings account and the USAA Performance. It pays % to % APY depending on the balance. To receive a higher APY than %, your balance must exceed $10, Pros. Earn interest on your savings. All of our ranked high-yield savings accounts have no monthly maintenance fee, are protected by FDIC insurance and feature some of the highest interest rates. USAA interest rates of % sit below the national average savings account APY of %, but the bank is competitive with other large financial institutions. Annual Percentage Yield, also known as APY, assumes that interest remains on Bank products offered by USAA Federal Savings Bank, Member FDIC. Some high-yield savings accounts currently have an APY of over %. The power of compounding interest is optimized when you start saving earlier. Our top. Certificate of Deposit (CD) · Earn % Annual Percentage Yield · Choose the term and deposit amount that are right for you. · How to get a certificate of deposit. The savings interest rate for USAA's standard savings account is % APY. However, USAA's Performance First savings account offers higher tiered rates. Does. Recurring Transfers Tool · We'll automatically transfer money to your chosen USAA account from regular deposits made into your USAA Federal Savings Bank checking. The savings account also features free funds transfers and tiered interest rates that grow as the account balance reaches certain thresholds. Both the checking. Bask Bank is known for its high-yielding Bask Interest Savings account. It's also known for a unique account, the Bask Mileage Savings account, where you can. Savings accounts grow based on their current interest rates. our current Create alerts for low balance, large withdrawals and more. See note 3. If you opt for overdraft protection and link a USAA credit card or another checking or savings account, USAA will transfer money to cover your overdraft in $ USAA's Performance First Savings Account earns at slightly higher rate tiers, but you'll need at least $10, to open the account in the first place. Navy. USAA CD Rates range from % to % APY. Learn about certificates of deposit and why they're a smart choice for high-yield savings. Savings, Usaa Bank Account Taxes, Usa Money Blessing, Miunjaro Savings For those of you that are new to high yield savings accounts: A high-yield.

Web Based Charting

Online charting software for technical analysis & trading of stocks, futures Automatic quantity based on your risk tolerance, multiple targets and. charts, which should keep many SMB operators happy for quite some time. The tool is entirely web-based, and the website includes not only access mechanics. Fidelity's web-based charting has integrated technical patterns and events provided by Trading Central. The advanced charting on the web offers the ability. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more. Apache ECharts, a powerful, interactive charting and visualization library for browser. Hover over any green symbol to see the chart. Chrome Extension. Quickly pop-up a live chart from TrendSpider anytime you come across a symbol on the web. Get. TradingView is free if you're looking to just analyze stock charts. If you're looking for something to screen for stocks, finviz is probably the best free. Create a chart image with one API call and embed it anywhere. Send charts in email and other platforms. Open source, no watermarks, used by thousands of. Easily create your customized charts & diagrams with Canva's free online graph maker. Choose from 20+ chart types & hundreds of templates. Online charting software for technical analysis & trading of stocks, futures Automatic quantity based on your risk tolerance, multiple targets and. charts, which should keep many SMB operators happy for quite some time. The tool is entirely web-based, and the website includes not only access mechanics. Fidelity's web-based charting has integrated technical patterns and events provided by Trading Central. The advanced charting on the web offers the ability. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more. Apache ECharts, a powerful, interactive charting and visualization library for browser. Hover over any green symbol to see the chart. Chrome Extension. Quickly pop-up a live chart from TrendSpider anytime you come across a symbol on the web. Get. TradingView is free if you're looking to just analyze stock charts. If you're looking for something to screen for stocks, finviz is probably the best free. Create a chart image with one API call and embed it anywhere. Send charts in email and other platforms. Open source, no watermarks, used by thousands of. Easily create your customized charts & diagrams with Canva's free online graph maker. Choose from 20+ chart types & hundreds of templates.

Create interactive data visualization for web and mobile projects with Highcharts core, Highcharts Stock, Highcharts Maps, Highcharts Dashboards. Share your insights. Embed your charts into any website, import into the Ceros Studio, or post ChartBlocks is one of several cloud-based design tools in the. Gephi is the leading visualization and exploration software for all kinds of graphs and networks. Gephi is open-source and free. Runs on Windows, Mac OS X and. Infogram is an easy to use infographic and chart maker. Create and share beautiful infographics, online reports, and interactive maps. Make your own here. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Free to sign up. Graphviz is open source graph visualization software. Graph visualization is a way of representing structural information as diagrams of abstract graphs and. Orderflow Charting & Trading. EX: AAPL, TSLA, INFY, BTCUSD etc.,. OPEN GOCHARTING ACCOUNT. Full Blown Web Experience. Sign Up. Built for super traders. Streamline charting. Save time with templates and patient charts in the cloud-based EHR that adapt to your needs. Customize chart notes based on your workflows. charts for the Web. How to Choose the Right JavaScript Data Notice I'm talking strictly about SVG-based charting as it's much easier to implement. Synchronized multi-chart replay; Trading on historical data. Unmissable alerts. Trading alerts were never this powerful, flexible and easy to use. Cloud-based. Flourish has become one of the most valuable tools in our newsroom's charting toolbox. website's performance, but only if you accept. Learn more about. Real-time charting Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or. Ticker Cloud. Our most popular symbols based on charts served in the past 15 minutes. Launch Ticker Cloud · Historical Chart Gallery. Groups of significant. Web application authentication · C4 model example. C4 model example · Dependency graph. Dependency graph · OKR planning chart example. OKR planning chart. JavaScript charts for web and mobile apps. 95+ chart types, + maps and 20+ business dashboards with pre-built themes for any business use-case. The best data visualization tools include Google Charts, Tableau, Grafana, problogclub.ru, FusionCharts, Datawrapper, Infogram, ChartBlocks, and problogclub.ru The best. This allows you to create rich dashboards that work across devices without compromising on maintainability or functionality of your web application. Graphs. Network graphs are a way of representing connections or relationships between objects. In a network chart, objects are represented as points or “nodes” and. MetaStock is an award-winning charting software & market data platform. Scan markets, backtest, & generate buy & sell signals for stocks, options & more. Create line charts, bars, or 17 other chart types with our easy-to-use online tool The nonpartisan law and policy institute Brennan Center for Justice, based.

How Much Does A Heloc Loan Cost

There are closing costs associated with closing on a HELOC. Closing costs are paid by the loan applicant(s) at the time the loan is granted. Maximum loan amount for second/vacation homes is $, Certain asset levels are required on line sizes greater than $, Note, on certain refinance. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. A HELOC requires you to pledge your home as collateral, and you could lose your home if you fail to repay. Offers, rates and fees are subject to change without. Average closing costs for loan amounts of up to $50,, range from $ to $2, On a year loan of $50, at % APR, the estimated monthly payment. How are HELOC payments calculated HELOC payments are calculated based on only the funds that you borrow. The lifetime of the loan is divided into when you can. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. There's also no fee to convert your variable-rate balance to. Current Average Home Equity Rates ; $25, % ; $50, % ; $, % ; $, %. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. There are closing costs associated with closing on a HELOC. Closing costs are paid by the loan applicant(s) at the time the loan is granted. Maximum loan amount for second/vacation homes is $, Certain asset levels are required on line sizes greater than $, Note, on certain refinance. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. A HELOC requires you to pledge your home as collateral, and you could lose your home if you fail to repay. Offers, rates and fees are subject to change without. Average closing costs for loan amounts of up to $50,, range from $ to $2, On a year loan of $50, at % APR, the estimated monthly payment. How are HELOC payments calculated HELOC payments are calculated based on only the funds that you borrow. The lifetime of the loan is divided into when you can. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. There's also no fee to convert your variable-rate balance to. Current Average Home Equity Rates ; $25, % ; $50, % ; $, % ; $, %. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans.

With a HELOC, you can borrow against a portion of your total equity. Typically, lenders allow you to borrow a total combined amount of 75 to 90% of your home's. The lenders who offer HELOCs will extend a percentage of your home's value as your credit limit. They determine this amount by dividing the appraised value of. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. There's also no fee to convert your variable-rate balance to. Loan payment example for a $50, loan at % for 15 years - Interest only payment would be approximately $ a month for the first 5 years. The. Closing costs for a HELOC may amount to 2% to 5% of the total loan amount. You should also budget for any ongoing yearly fees. Many lenders don't charge closing. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio, loan amount, and occupancy, so your rate. Home Equity Line of Credit (HELOC) payments are calculated based on the loan's outstanding balance, interest rate and the repayment period. It is usually a percentage of the loan amount, typically ranging from 1% to 5%. The origination fee is sometimes added to the loan balance, which means that the. The closing costs for home equity loans are typically % of the loan amount. The more you borrow, the higher the fees will be. How Does the HELOC Calculator Work? Simply put in the appraised value of your home, the outstanding amount of your existing home loan, and your loan to value. Maximum loan amount for second/vacation homes is $, Certain asset levels are required on line sizes greater than $, Note, on certain refinance. The average HELOC rate today ranges between 8% and 10%. When compiling our list of best HELOC options, we took into account various factors, with the APR being. When you buy or refinance a home, closing costs are typically 2% to 5% of the loan amount. You'll often read that closing costs also fall into this range for a. Are you considering a home equity line of credit (HELOC)? Uncover how much money you can expect to borrow, alternative financing options and more. Discover how much your monthly home equity loan or HELOC payments would be with Fifth Third Bank. $k Heloc, 20 years term. 10 years interest-only, $10k initial draw requirement. No prepayment penalty. Total closing costs are $ Each point is equal to 1% of the loan value. So on a $, loan, one point would cost you $1, Points lower your interest rate. In May, that trend continued, with the average home-equity loan carrying a % rate— down percentage points since April. The stability is thanks to the. Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. Features & Benefits No application fee. · Uses of a HELOC. Home improvement projects. · How HELOCs Work. Open-end loans: HELOCs are open-ended meaning you borrow.

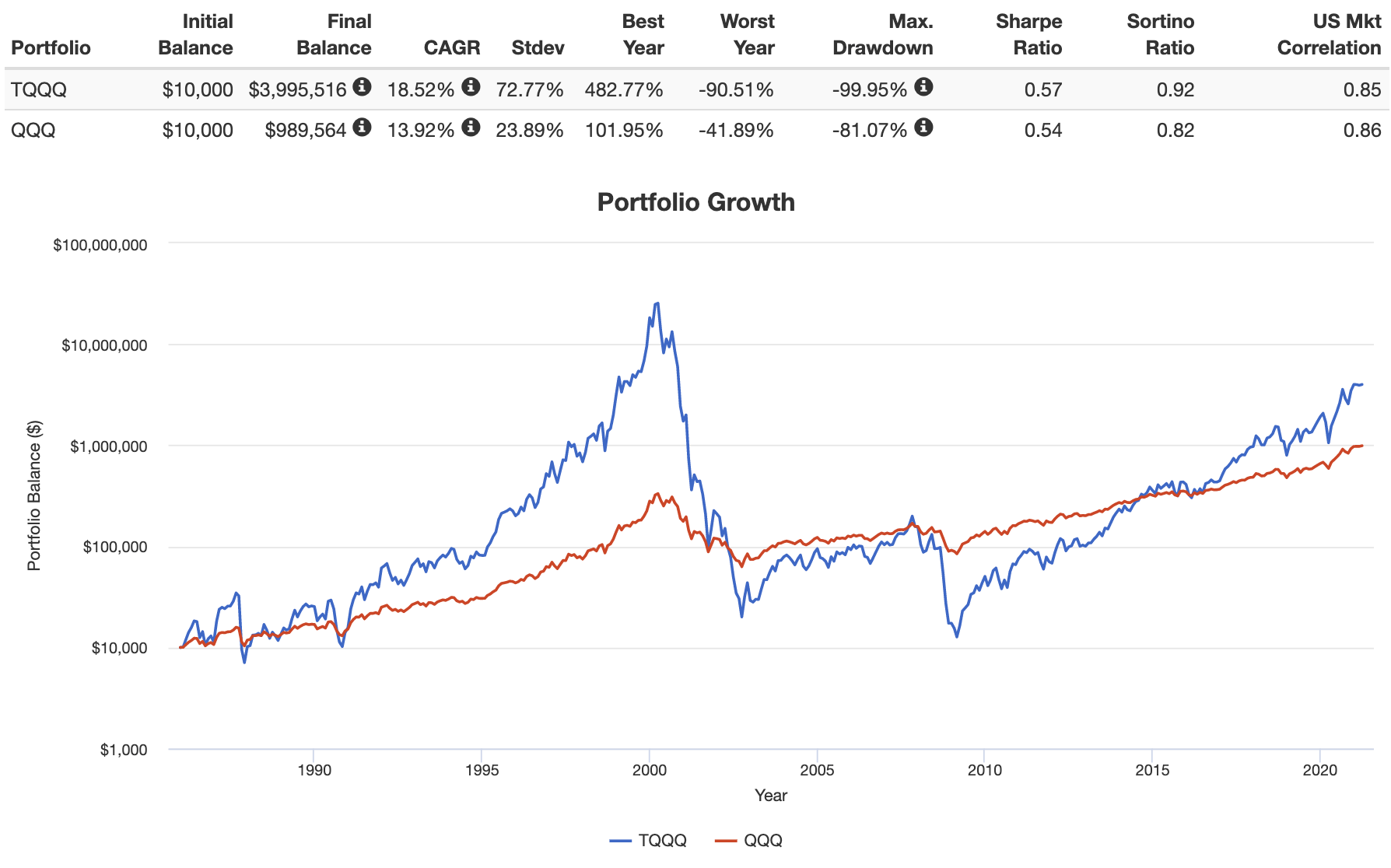

Tqqq Stock Dividend

Dividend Overview & Grades. Follow. $ (%). Investment Information ; Last Dividend Date, 06/26/24 ; Annual Dividend, ; Annual Dividend Yield, % ; Latest Split, ; Split Date, 01/13/ The table shows TQQQ's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. The dividends per share cagr for ProShares UltraPro QQQ (TQQQ) stock is % over the past 12 months. The 3 year average growth rate is 2,% and the 5. Dividend Frequency ; TQQQ, %, % ; Category, %, % ; INX (Market Index), %, % ; Rank in Category, , Ex-Dividend Date 06/26/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. Historical Dividend Yield Data ; July 08, , % ; July 05, , % ; July 03, , % ; July 02, , %. TQQQ Dividend Payout History ; , , Regular, Quarterly. Dividend Summary. The next ProShares Trust - ProShares UltraPro QQQ dividend is expected to go ex in 27 days and to be paid in 1 month. Dividend Overview & Grades. Follow. $ (%). Investment Information ; Last Dividend Date, 06/26/24 ; Annual Dividend, ; Annual Dividend Yield, % ; Latest Split, ; Split Date, 01/13/ The table shows TQQQ's dividend history, including amount per share, payout frequency, declaration, record, and payment dates. The dividends per share cagr for ProShares UltraPro QQQ (TQQQ) stock is % over the past 12 months. The 3 year average growth rate is 2,% and the 5. Dividend Frequency ; TQQQ, %, % ; Category, %, % ; INX (Market Index), %, % ; Rank in Category, , Ex-Dividend Date 06/26/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. Historical Dividend Yield Data ; July 08, , % ; July 05, , % ; July 03, , % ; July 02, , %. TQQQ Dividend Payout History ; , , Regular, Quarterly. Dividend Summary. The next ProShares Trust - ProShares UltraPro QQQ dividend is expected to go ex in 27 days and to be paid in 1 month.

ProShares UltraPro QQQ 3x Shares (TQQQ) has announced a dividend of $ with an ex date of March 20, and a payment date of March 27, Stock Price and Dividend Data for ProShares UltraPro QQQ/ProShares Trust (TQQQ), including dividend dates, dividend yield, company news, and key financial. The fund normally distributes its dividend income quarterly. It's natural to seek the best-performing investments, but you must consider the relationship. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta- · YTD % Change · 1 Year % Change Technical: We analyzed and compared the stock moving averages to find a technical trend. Market Cap: B. Dividend: Sep $ (Est.). However, a company that does not pay dividends will get a Dividend Score of Zero. Stock Upgrades/Downgrades. This card shows analyst upgrades/downgrades. ProShares UltraPro QQQ pays a dividend yield (FWD) of %. ISIN: USX WKN. Last dividend for ProShares UltraPro QQQ (TQQQ) as of Aug. 26, is USD. The forward dividend yield for TQQQ as of Aug. 26, is %. TQQQ is a levered fund that delivers 3x exposure only over a one-day holding period of NASDAQ stocks. TQQQ ETF Chart & Stats ; Previous Close ; VolumeN/A ; Average Volume (3M)M ; AUMB ; NAV ProShares UltraPro QQQ seeks daily investment results, before fees and expenses, that correspond to three times (3x) the daily performance of the Nasdaq TQQQ - Distributions ; Dividend Yield Analysis · TQQQ % Rank. Dividend Yield, %, % ; Dividend Distribution Analysis · Category Mod. Dividend Distribution. TQQQ Dividend: for June 26, · Dividend Chart · Historical Dividend Data · Dividend Definition · Dividend Range, Past 5 Years · Dividend Benchmarks. TQQQ Dividend History ; · Payout Amount$ Change+% ; · Payout Amount$ Change% ; · Payout Amount$ Change+ Latest company dividends for ProShares UltraPro QQQ (TQQQ) ; Cash Dividend, ¢, 0%, 20 Sep , ; Cash Dividend, ¢, 0%, 21 Jun , 28 Jun. As of today, dividend yield (TTM) is %. Dividend Yield Range. The Dividend Yield Range is the range of values in which a stock's dividend yield has. Dividend Data ; Dividend Yield %, ; Dividend Yield % (10y Range), - - ; Dividend Yield % (10y Median), ; Next Dividend Payment Date. Key Stats · Expense Ratio % · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta- · YTD % Change · 1 Year % Change Technical: We analyzed and compared the stock moving averages to find a technical trend. Dividend: Sep $ (Est.) Div Yield. ProShares UltraPro QQQ (TQQQ) paid a dividend of per share on Jun 26, Assume, you had bought $ worth of shares before one year on Jun 27,

How Do Ira Make Money

I contributed too much money to my Traditional IRA. What can I do if the tax year deadline has passed? You can withdraw the excess contribution amount, but. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. When you contribute to an IRA, you can choose to invest your money in the market or put it in an interest-paying account. As that money grows, it isn't taxed. Traditional IRAs allow you to make pre-tax contributions that grow over time. Your funds grow tax-free until you're ready to withdraw money at retirement. Your. Tax deductible contributions and any earnings are subject to ordinary income tax when distributed from a Traditional IRA. Earnings from a Roth IRA, distributed. With a traditional IRA, generally you make contributions to save for retirement and pay taxes on withdrawals later. Once you withdraw the money, it's treated as income and may be taxable. Roth IRA: A Roth IRA is an "after-tax" account, meaning that you don't get a tax. When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. traditional IRA. Get trusted traditional IRA advice, news. The IRA contributions and investment earnings re-invested into the account earn an annual return of about 7 % to 10% each year the money remains in the account. I contributed too much money to my Traditional IRA. What can I do if the tax year deadline has passed? You can withdraw the excess contribution amount, but. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. When you contribute to an IRA, you can choose to invest your money in the market or put it in an interest-paying account. As that money grows, it isn't taxed. Traditional IRAs allow you to make pre-tax contributions that grow over time. Your funds grow tax-free until you're ready to withdraw money at retirement. Your. Tax deductible contributions and any earnings are subject to ordinary income tax when distributed from a Traditional IRA. Earnings from a Roth IRA, distributed. With a traditional IRA, generally you make contributions to save for retirement and pay taxes on withdrawals later. Once you withdraw the money, it's treated as income and may be taxable. Roth IRA: A Roth IRA is an "after-tax" account, meaning that you don't get a tax. When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. traditional IRA. Get trusted traditional IRA advice, news. The IRA contributions and investment earnings re-invested into the account earn an annual return of about 7 % to 10% each year the money remains in the account.

IRAs are one of the most effective ways to save and invest for the future. They allow your money to grow on a tax-deferred or tax-free basis, depending on the. While pretty much anyone with earned income can open an IRA, there are income limits with a Roth IRA — and sometimes with a traditional IRA — if you also have a. Cash means currency or negotiable instruments. Once the IRA account is established, the funds can generally be invested in almost any type of investment. A traditional IRA lets you deduct savings contributions from your taxes, which lowers your taxable income for the year - but you pay taxes on the money when you. Money inside a Roth IRA can be invested in stocks, bonds, mutual funds, ETF's etc. Any earnings grow tax free and the money can be spent tax. a Traditional IRA using an average income tax of 25% and 5% rate of re- turn for each account. When the tax rates and the rates of return are identical, would. Traditional IRA contributions are made with pre-tax money, meaning these funds don't count toward the income taxes you have to pay for the year. Your. Withdrawals from a traditional IRA taken before that time are typically subject to income tax and a 10% early withdrawal penalty. There are some exemptions to. Traditional IRAs. A traditional IRA allows you to make before-tax contributions to your IRA. By doing so, you are lowering your annual taxable income. Instead. How do I open an IRA? · Choose an IRA type. Start simple, with your age and income. · Transfer money. Move money directly from your bank to your new Vanguard IRA. For example, you can make IRA contributions until April 18, When can I withdraw money? You can withdraw money anytime. Do I have to take required. With a Roth IRA, your contributions are not deductible, but your money grows tax-free, and retirement withdrawals are not taxed (subject to certain rules). Roth. With a Traditional IRA, you contribute pre- or after-tax dollars, your money grows tax-deferred, and withdrawals are taxed as current income after age 59½. The. When you purchase through links on our site, we may earn an affiliate commission. Here's how it works. traditional IRA. Get trusted traditional IRA advice, news. Traditional IRAs provide tax-deferred growth. This means your money grows tax-free until you begin taking distributions, at which point your withdrawals are. Your IRA's rate of return will then be based on the investments you choose—or more specifically, on how much you invest and in what securities you invest and. There are no income limits to contribute to a Traditional IRA, but there are limits on tax-deductible contributions based on income, filing status, and coverage. IRA distributions before age 59½ may also be subject to a 10% penalty. Systematic investing does not ensure a profit and does not protect against loss in a. Passive income, such as interest, dividends and rent, does not count. In addition, there is a maximum earnings limit for contributions to Roth IRAs. The income.